Vulnerable Americans Will Suffer So My Taxes Can Stay Low

Understanding Trump’s Big, Beautiful Budget Bill

There’s a consequential budget Bill (the “Bill”) moving its way through Congress. An outline of the Bill was passed in the House of Representatives on February 25th. The final Bill could potentially come up for a vote soon, although timing is uncertain.1

Executive Summary:

The Bill would avoid a large tax increase that would take money out of the economy.

The Bill would cut crucial spending on food and healthcare for poor and working-class Americans.

The Bill would add significantly to America’s annual deficit and national debt because avoiding the tax increases costs a lot more than the savings from spending reductions.

Does the National Debt really matter? I say yes.

This Bill and past budget Bills under Trump 1.0 and Biden use an arcane procedure called “Reconciliation” to pass the Senate by simple majority. Reconciliation is a deeply flawed way to run the finances of our country.

Passage of the Bill is not a certainty because the Republican margin in the House of Representatives is only four votes. Out of 218 Republican votes, only two, perhaps three, “no” votes could kill the Bill.

Every Representative stands for election on a two year cycle; they can be persuaded by the activism of their constituents.

My best argument for the Bill is to view it as a shift in taxing and spending from the Federal government to state and local governments.

Since I oppose this Bill, it’s only fair that I suggest an alternative.

God, the devil, and everything in between is in the details. When you’re talking about budgets, the details are generally in the numbers, which are at the end of this post in the footnotes along with links to source materials.

The Bill would avoid a tax increase.

In 2017, Congress passed a Bill that cut taxes for individuals. But the tax cuts were not permanent. They lasted for eight years. At the end of 2025 the reduced tax rates are set to snap back to where they were in 2017. Eight years is a long time, and we’ve become accustomed to the current tax rates as the status quo.

People generally refer to the Bill as a tax cut. That’s functionally wrong. If the old, higher rates return, it will feel exactly like a tax increase. A lot of money will leave the economy to go to the government. That will be a drag on growth and could tip the economy into a recession.

While it’s true that the wealthy gained the most from the 2017 tax Bill, the tax cuts were across the board. If the old rates return, the wealthiest 0.1% would on average pay about half a million a year more in tax. At the same time those households with income from $35,000 to $64,000 would pay about $1,000 more in tax.

One could take the position that a $1,000 reduction in after tax income is more important to a working-class family than half a million is to a family that has over $100 million in net worth.

In any event, I believe that the U.S. does not collect enough in taxes from our wealthiest people to pay for an adequate social safety net or to control our national debt burden. Among our wealthy peer nations, we stand out as a low tax, low social safety net, high poverty country. 2

The Bill would hurt the most vulnerable among us by reducing Medicaid and SNAP benefits.

The Bill requires significant spending reductions to Medicaid, which is health insurance for the poor and many working class families. Obamacare raised the income caps for families to qualify for Medicaid. For example, a working-class family of four earning $40,000 is currently Medicaid eligible. This Bill would effectively take that coverage away.

Alternatively, or in addition, Medicaid spending might also be reduced by imposing a work requirement in order to be eligible.

Millions of vulnerable Americans would likely return to the ranks of the uninsured and lose their access to healthcare. If that happens, many diseases and perilous conditions will go untreated and people will die.

Another big chunk of spending reductions is anticipated to come from cuts to SNAP benefits which are “food stamps” for the poor.

These reductions of the most basic needs, which are cruelly targeted at the most vulnerable of our citizens, are shameful, immoral, and contrary to all religious and ethical codes and traditions with which I’m familiar.

The question to ask is why are these harsh spending reductions necessary. Why can’t the Bill leave Medicaid and SNAP benefits alone and just avoid the tax increase? 3

The extraordinary current level of our national debt burden

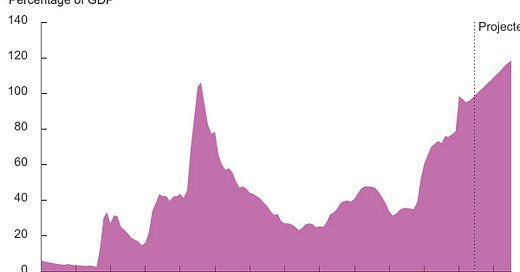

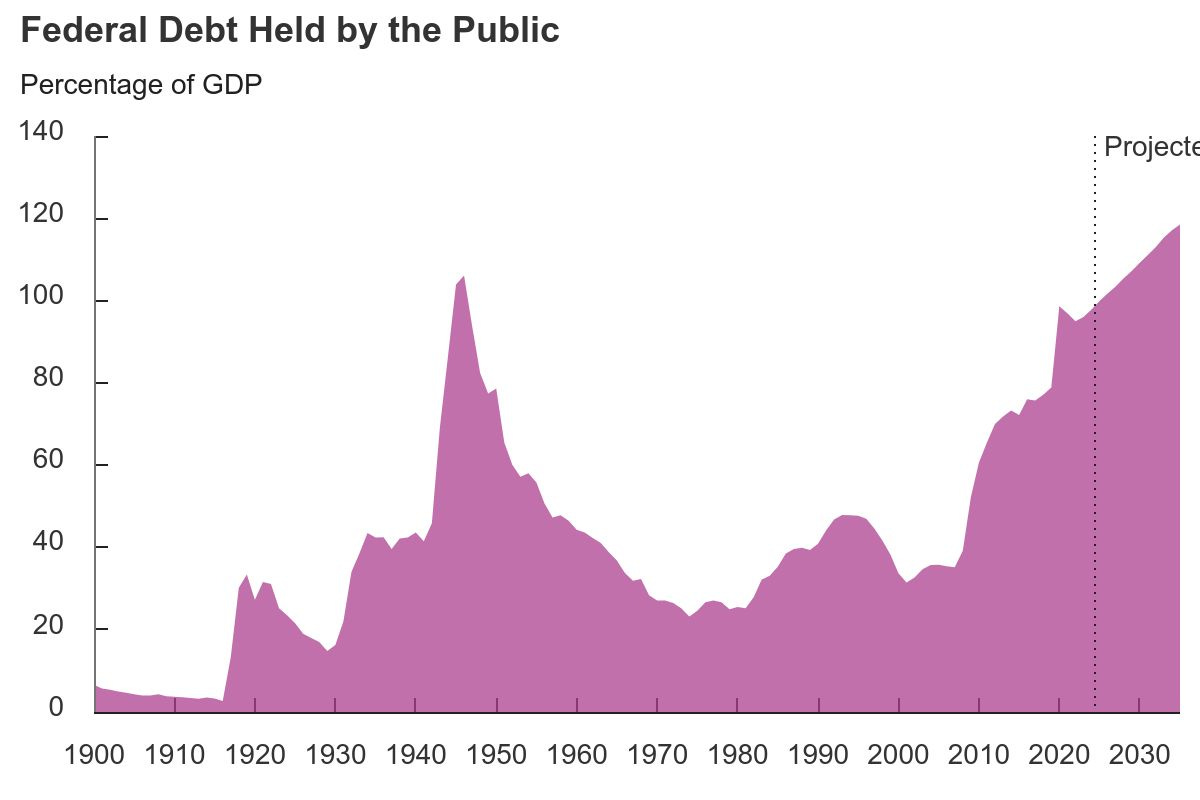

Below is a chart showing the history of our national debt since 1900 calculated relative to the size of our economy. Each year, deficits add to the national debt and surpluses pay the national debt down. We haven’t had a surplus since 2001.

This chart is before any effect of the Bill. It’s based on current law, which assumes that tax increases kick in starting next year.

The Bill would add to the deficit because the cost of avoiding the tax increases is far greater than the spending reductions. A chart that accounted for the Bill would show an even steeper climb in debt.

Our debt skyrocketed during World War Two when we played an indispensable role in saving the world from the Axis powers of Nazi Germany, Imperial Japan, and Fascist Italy. When the war ended, we reduced the debt burden.

For about 65 years after that, our debt never approached the same high levels until it started rising steadily and precipitously from around 2010 under both Democratic and Republican Presidencies and Congresses.

Many people, including me, are concerned about our extraordinary level of debt. So, too, are a number of Republican Representatives. That’s why in order to pass the Bill and avoid the tax increases, these Republican “deficit hawks” insisted on spending reductions. They chose to hit the most vulnerable Americans.

Footnote 4, has more detailed numbers on national debt and deficits as well as a discussion of the difficulty of estimating DOGE’s efforts to reduce spending. 4

Does the national debt really matter

Does the continued, rapid growth in our national debt really pose a risk? And if so, at what point?

The truth is we don’t know what that point is. Maybe the United States can go on borrowing at reasonable interest rates no matter how high the debt grows. That would be against both common sense and history but some economists believe it’s true.

I think of it as a question of risk.

Imagine you’re walking in an open field toward a forest. The sun is shining and birdsong fills the air. Because why not.

Somewhere between you and the forest, there stretches a belt of deadly land mines. The closer you get to the forest the closer you get to the hidden land mines. The sensible thing to do would be to stop walking.

Every step is an incremental risk, just like every increase in our national debt is an incremental risk that at some point American credit might spiral out of control and create a devastating financial explosion.

The Reconciliation process is partly responsible for our extraordinary debt burden.

The Reconciliation process is a hall of funhouse financial mirrors. It pretends to impose fiscal discipline but it does the opposite by making it easier to pass budget bills that cater to the immediate gratifications of the American public. Over the past eight years, using Reconciliation, we’ve had both increased spending and reduced taxes, which is why our debt burden has continued to rise so rapidly.

Reconciliation is used because most Bills in the Senate require 60 votes (60%) to be passed. It’s been a long time since either party had 60 of the 100 Senate seats (2010-11). We’re a closely divided country between our two major parties.

However, a Reconciliation bill requires only a majority of votes in the Senate with the Vice-President breaking a tie. So only 50 votes are needed rather than 60.

There are a number of attributes required for a Bill to qualify as a Reconciliation Bill. Here are the three major ones.

1) The Bill’s provisions must only be about revenues and spending.

2) The Bill cannot change the terms of social security.

3) The tax and spending provisions of the Bill can increase the projected deficits over the ten years after the budget is passed but not over the subsequent ten years, i.e., years eleven to twenty. This calculation is based on projections prepared by the Congressional Budget Office.

It’s this last attribute that’s the most important and troubling one. It’s why provisions of Reconciliation bills, like the 2017 tax bill, typically sunset before the initial ten-year period is over because the baseline of projected deficits from future years eleven to twenty would otherwise be higher.

The 2017 reconciliation bill was allowed to increase deficits from 2018 through 2027. It could not increase the then projected deficits beyond 2028. Now, the 2025 Bill can increase deficits from 2026 to 2035. It can’t increase projected deficits beyond 2035.

If this sounds confusing, it’s because it is. If this sounds like a ridiculous way to handle the budget process, it’s because it is.

Passage of this Bill is not a done deal

In the House of Representatives, there are currently 218 Republicans and 214 Democrats. After April 1st, that will change to 220 to 214.

I’m assuming that all Democrats will vote against the Bill.

That means that if more than one, possibly more than two, House Republicans votes no, the Bill is defeated. A margin of two or three Republican members is incredibly tight given a total of 218 to 220 Republican members.

As mentioned above, there are Republican Representatives who are concerned about the debt burden. In fact, the preliminary Bill was passed by a vote of only 217-215, because one Republican voted no and said:

"We have no plan whatsoever to balance the budget other than growth, but what they're proposing is to make the deficit worse…"

Then there are some Republican Representatives who are concerned that many of their constituents, i.e., their voters, will be badly hurt by the spending reductions. In Congressional districts that are closely divided between Republicans and Democrats, the Bill’s economic pain could cause a Republican representative to lose their 2026 election. All House representatives serve two-year terms (Senators serve six-year terms). 5

Below is a clip from a contentious March 2nd Town Hall held by Texas Republican Representative Keith Self. While town halls may not be held in the weeks leading up to the vote on the Bill, your calls and emails can have an impact.

An Argument for the bill

The Bill’s spending cuts are aimed at programs that are paid for and administered not exclusively by the Federal government but also by state and local governments. So it’s possible that states could make up the loss of Federal spending by increasing their own spending on Medicaid and other social safety net programs.

Perhaps the Bill could be viewed as an effort to shift more spending to the states. And it’s generally true that spending becomes more efficient the more locally it’s structured and administered.

However, states are required to balance their budgets. So to make up for the Bill’s spending reductions, states would have to significantly increase their revenues in the form of increased taxes, whether sales, property, income, or other. Many state budgets are already stressed and even before this challenge to the social safety net, many states will have to raise taxes and cut spending to balance their budgets.

So I don’t see this as a viable solution, certainly not in the short term. As well, increased state taxes would vitiate the one virtue of the Bill, which is not to increase taxes.

An alternative

I find the 2025 budget Bill to be deeply immoral. It would harm the poor and the working class and mostly benefit the rich. It bears repeating that vulnerable people will lose access to health insurance and some will die because of that lost coverage. We should be prepared to pay more in taxes to prevent that from happening. Particularly the wealthy among us.

And we shouldn’t continue to take the risk of increasing our national debt burden.

My alternative would be a bill that

did not slash safety net spending,

retained lower tax rates below a certain level of income,

paid for those lower tax rates by imposing higher taxes on people above that level of income.

That would help reduce economic inequality without adding to the national debt. It would be a step in the right direction.

Sources

Text of the resolution passed in the House

CBO Ten Year Budget projections

Penn Wharton Budget Center Analysis of the Bill

On March 14th, the continuing resolution to fund the government runs out. The continuing resolution is a stopgap measure. In order to continue funding the government, a bill would need to be passed in both the House and the Senate. If the funding is a standalone bill, it would need 60 Senators and a majority in the House. It’s not clear if the votes are there.

However, if funding the government is part of a reconciliation bill, then it can be passed with only 50 votes in the Senate. Another wrinkle is that on April 1st, there will be two special elections for vacant Republican seats in Florida. So after April 1st, the Republican margin in the House will increase from 218-214 to 220 to 214. A little more room for defections.

The reason the Democrats have 214 seats and not 215 is that earlier this week a Democratic Representative died suddenly.

In the House, a tie vote means the issue up for vote does not pass.

The Bill provides for $4.5 trillion of aggregate tax revenue reductions. About $3.2 trillion is due to continuing the 2025 individual tax rates and about $0.8 trillion is due to reinstating various business tax breaks that expired a few years ago. These numbers are for eight years because of reconciliation math.

The remaining $0.5 trillion is unallocated but could be used for other tax changes like increasing the $10,000 limit in deducting State and Local Taxes from Federal taxable income. Both Democratic and Republican Representatives in states like New York and California with high state income and property taxes will be pushing hard for this.

In terms of comparisons with other countries, according to the OECD and the IMF, the U.S. spends and taxes significantly less than its peer wealthy countries in Western Europe, Canada, and Australia. Different methodologies yield different numbers but the significant gap is roughly consistent. The same holds true for poverty rates.

The Bill provides for spending reductions of about $2 trillion over the ten-year period from 2026 to 2035. The main reductions are:

$0.88 trillion from the House committee that oversees Medicaid,

$0.33 trillion from the committee that oversees Head Start programs, school meal programs, and federal student aid, and

$0.23 trillion from the committee that oversees SNAP benefits.

There are other required reductions plus another $0.5 trillion of unallocated reductions.

All the reductions add up to $2.0 trillion.

However, there are also $0.3 trillion of spending increases for homeland security, defense, and law enforcement. So the net spending reduction is $1.7 trillion.

In terms of Medicaid, here’s an important point from MedPageToday; N.Adam Brown; March 8th:

“While 80 million Americans are insured through Medicaid, many people don't think of themselves as "on Medicaid" -- even when they are.

Why? Because Medicaid is not branded as Medicaid in most states If you tell a patient in South Carolina they might lose Medicaid, their eyes may glaze over. Tell them Healthy Connections is at risk? You have their attention. In Tennessee, Medicaid is TennCare and in Ohio it is the Buckeye Health Plan. In Florida, Medicaid sounds like an orange juice brand: Simply Healthcare. (Seriously, it feels like that moniker should have an exclamation point behind it.)”

Taking into account both the reduction of tax revenues and the spending cuts, the increase in deficits over the next ten years is fixed at $2.8 trillion, calculated as $4.5 trillion of lower tax revenues less $1.7 trillion of net spending reductions. It’s fixed because if the spending reductions are different than $2 trillion the tax cuts will be changed. For example, if budgeted spending reductions come in lower at $1.5 trillion, the allowable tax cuts will be reduced to $4 trillion. If budgeted spending reductions come in higher at $2.5 trillion, the allowable tax cuts will be increased to $5 trillion.

The Congressional Budget Office (“CBO”), an independent agency, periodically publishes ten-year forecasts of the Federal budget. Their last forecast was published in January of this year. The forecast is based on the current laws at the time the forecast is made.

The CBO forecasts a deficit in 2025 of about $1.9 trillion. Then in 2026, the forecasted deficit drops to about $1.7 trillion because of the expiration of the tax cuts described above under current law. The projected deficit then steadily rises reaching $2.5 trillion in 2035. The increase is mainly due to forecast increases in Social Security (retirement payments generally starting at age 65), Medicare (health insurance for people 65 and older regardless of income), and Medicaid.

The projected increases are not surprising. We have an aging population that will receive far more aid from the government that it contributes in taxes.

The current CBO projection of deficits over the next ten years totals about $21.8 trillion. If the proposed budget bill is passed as currently outlined, the deficit over the next ten years would increase that deficit total by $2.8 trillion to $24.6 trillion. That’s before considering something called dynamic scoring, meaning that the CBO will try to estimate what the economic effects of changes to current law would be and how that might in turn affect revenues.

DOGE

As for the effort of Elon Musk and DOGE to cut costs, it’s hard to know any accurate numbers. First, the published reports of savings from DOGE have been riddled with errors, including counting contracts that had already been cancelled or completed and listing a savings initiative as $8 billion when it was really $8 million. Second, it’s not clear which cost cuts will survive court challenges. Third, some of the cuts have already been reversed such as the firing of key personnel in charge of Nuclear Safety. There could be political pressure to rehire others if the cuts cause disruption to services that the American public has grown used to. For example, adequate personnel to make visits to our national parks a pleasant experience.

Finally, DOGE fired the senior officials who have the most experience and success cutting waste and finding fraud, the Inspectors General. How can anyone believe that the loss of their expertise, their experience, and the message that their firing sends won’t add to waste and fraud?

Any Republican Representative who considers voting against the bill will be threatened by the administration and Musk to be “primaried.” Meaning that in 2026, a different Republican will be supported as the nominee of the party. Given the power and money of the administration and its allies, this is a powerful threat.

It’s been reported that this threat was used successfully against Senator Thom Tillis to change his vote in confirming Pete Hegseth as Defense Secretary.

As Trump Threatened a Primary, a G.O.P. Holdout on Hegseth Flipped

Great article. It never stopped blowing my mind that the working American voted for a man who would f*k them over

I’m a big fan of the perspective that you share. Thank you. Since moving back to the US after 27 years in the UK & France, I repeatedly ask Republicans, Conservatives and those who identify as ‘Libertarians’…

To please tell me - in this Capitalist system - who looks after the people who simply cannot look after themselves? Long or short term. It’s too easy to point to ‘lazy’ or ‘work ethic’ and ‘let the free markets decide’. Only when we recognise that the world is made up of many, many varieties of people & circumstances. Some born without physical or mental means, some living in circumstances beyond their control,

The role of government is so much more than just an economic one. Thank you for sharing, explaining & offering suggestions too. Oh, and not blaming. It’s rare.